Two Views of Natural Resources and U.S. Manufacturing

We recently came across reports from two leading consulting firms, McKinsey & Co., Inc. and the Boston Consulting Group (BCG), which both addressed the significant impact that the evolving markets for natural resources will have on the manufacturing sector. Interestingly, the two reports take quite different perspectives: McKinsey highlights the challenges that manufacturers will face in a world where demand for resources is growing faster than the expansion of supply. BCG, on the other hand, highlights the opportunities that newly burgeoning natural resources will provide to U.S. manufacturers. The difference in perspective from these two respected firms is driven by the different timeframes of their reports: BCG limits their horizon to the near and mid-term, not looking beyond this decade, while McKinsey’s analysis extends to the middle of this century. They may both be right.

BCG Sees Opportunities for US Manufacturing

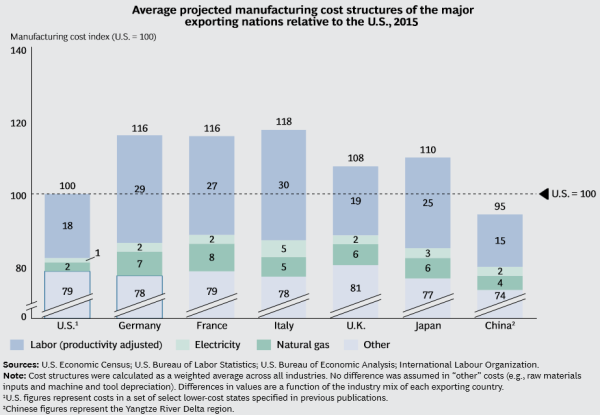

BCG’s report, The U.S. as One of the Developed World’s Lowest-Cost Manufacturers, explores a surprising development: the US has become one of the world’s low cost manufacturers. They arrive at this counter-intuitive conclusion through an analysis of three key inputs to manufacturing cost: productivity-adjusted labor costs, shipping costs, and a key natural resource, energy, both energy and natural gas. The net impact of America’s advantage in these three areas is that the U.S. manufacturing sector, on average, enjoys 8% to 18% lower operating costs than the major European industrial economies, France, Germany, Italy, and the UK, 10% lower than Japan, and only 5% higher than the vaunted industrial powerhouse, China (see chart). This latter figure represents a significant improvement from the 20% to 30% disadvantage that US manufacturers faced 10 to20 years ago.

Using Japan as an example, productivity-adjusted labor costs and lower shipping costs are responsible for 7% and 6% of the US advantage respectively, while Japan has an advantage of 2% in other costs. But the greatest turnaround for US manufacturers has been in the realm of energy costs. The remarkable expansion of natural gas and shale oil over the past decade has given US manufacturing an enormous boost. US manufacturers enjoy lower energy costs are lower than both its Chinese and European competitors.

The US cost advantage will drive the transfer of manufacturing activity to US. First, in situations where a slight cost disadvantage is less critical than the improvements in coordination, quality and shipping time, companies will “re-shore” manufacturing activity back to the U.S. Second, the significant cost advantage of US manufacturers will encourage transfer from the EU and Japan. Third, when managers are deciding where to construct new capacity, the US is likely to appear at or near the top of the list.

McKinsey: Managing Resources Will Be a Key Challenge

We encounter a very different perspective in the McKinsey report, Mobilizing for a Resource Revolution.

McKinsey starts by noting that the decrease in prices of natural resources was a key factor in the economic growth of the 20th century. However, over the last 20 years, we have witnessed rapid economic development in emerging economies eliminating the past century’s declines in natural resource prices. Moreover, McKinsey notes, expected population growth and continued economic development will continue to put strain on resource prices.

On the positive side, the company notes that technology could help alleviate the pressure. In particular, energy exploration, materials science, agricultural science, genetic engineering, and information technology will help business utilize resources more effectively.

Who Benefits in the New Environment?

In its view of an era of opportunity for American business, BCG sees a number of sectors benefitting particularly. Among them, there are several manufacturing sectors that they expect to see as winners:

- Transportation equipment

- Computer and electronic products

- Machinery

- Electrical equipment

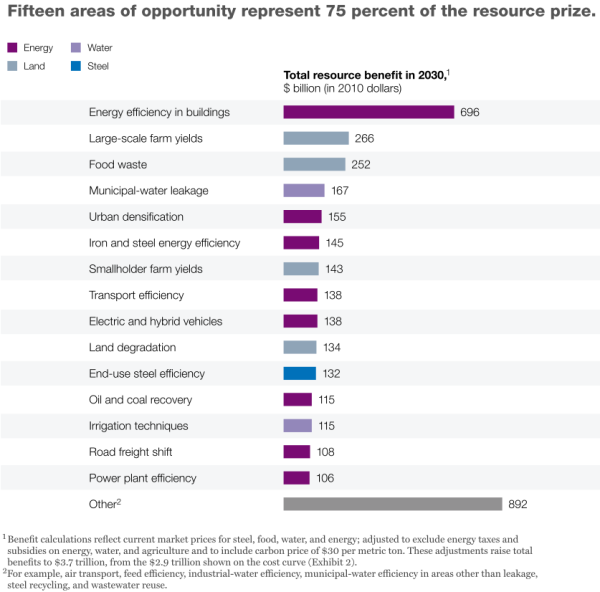

McKinsey looks at the other side of the equation, noting those sectors that address the macroeconomic scarcity of natural resources, forecasting that “consumers and companies to use or access resources more efficiently should be very good business in the years ahead.” The company identified 15 applications that have the greatest capability for using resources more efficiently (see chart below).

- Energy efficiency in buildings (e.g., Otis Elevator’s energy-efficient Gen2 line of elevators)

- Food waste (food processing equipment)

- Large scale farm yields (farm equipment, irrigation equipment)

- Next generation vehicles

- Battery technology

- Equipment improving energy efficiency

Implications for M&A

There are several implications for M&A in the Manufacturing sector:

- Transportation equipment, computer and electronic products, machinery, and electrical equipment are likely to experience increased competition and consolidation.

- Companies that take the lead in helping businesses or consumers to use resources more efficiently will reap greater economic rents, which will enable them to acquire complementary competitors.

- Foreign manufacturers will acquire capacity in the US, though they will target high quality advanced manufacturers, not industry laggards.

- Successful domestic acquirers will seek to cement position, acquiring companies with special capabilities or customer relationships, to take advantage of growth opportunities.

Diversified Industrials

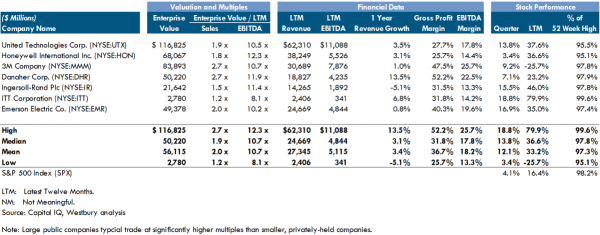

Diversified Industrials consists of those manufacturing companies whose production encompasses a broad range of offerings. For example, Danaher Corp. (NYSE:DHR) produces test and measurement equipment, electromechanical components and subsystems for the industrial automation and packaging markets, ultraviolet water treatment systems, and commercial printing systems, just to name several.

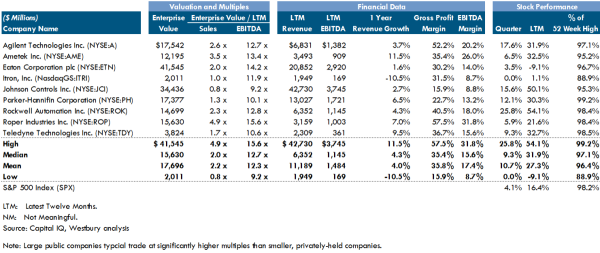

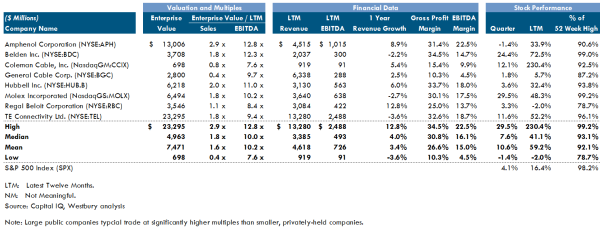

Diversified Industrials Public Comparables

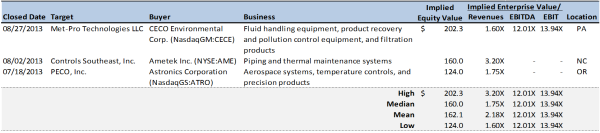

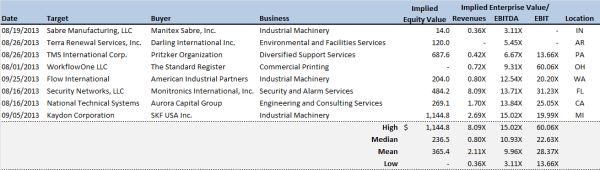

Diversified Industrials Selected Transactions

Electrical and Electronic Components

Electrical and Electronic Components Public Comparables

As of December 9, 2013, Molex Incorporated operates as a subsidiary of Koch Industries, Inc.

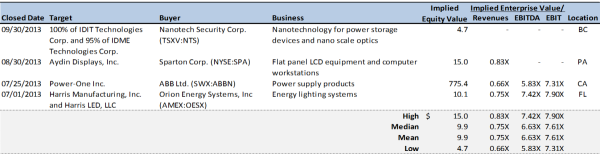

Electrical and Electronic Components Selected Transactions

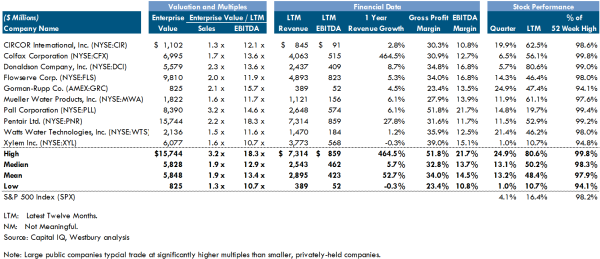

Flow Control

Companies in the flow control sector are involved in the manufacture and distribution of industrial process controls such as industrial valves, pumps and filters such as those used in oil and gas, chemical manufacturing and water treatment. Many of these companies also have fluid metering products such as gauges and pressure monitoring devices.

The flow control sector continued its solid recovery and is on track to exceed a 5% revenue growth for 2013. Oilfield services is one of the main drivers of this strong performance due to the rapid expansion of US domestic drilling and production activities due to both demand and hydraulic fracturing. Overseas demand, particularly in Africa and Latin America, is helping US manufacturers of valves, pumps and filters.

The other bright spot in the market is the water and wastewater treatment sectors. Demand from municipalities for pollutant control and monitoring equipment continues strong. Smart valves with automatic actuators or those with the technology to analyze performance and maintenance requirements are showing double digit growth. Overseas demand is being fueled by increasing urbanization and also the need for more desalination plant to provide usable water.

M & A activity during the third quarter continued to show sustained recovery from the recent recession, with both strategic players consolidating market positions and financial buyers that are hoping to build up a position in a healthy niche vying for the smaller players. Most of the closed transactions were for smaller privately-held companies. Such as Curtiss-Wright Flow Control Corp.’s acquisition of Gulf33 Valve Pros which will be integrated into its O & G division. Another example was the purchase by McJunkin Red Man Corp. of the flow control business of privately-held Dan Brown Inc. giving MRC a stronger position in the oilfield services business in the Permian Basin and Texas Panhandle.

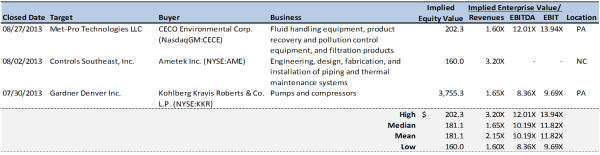

Turning to the larger transactions, KKR completed its $4.1 billion acquisition of Gardner-Denver Corp. announced in the first quarter. Gardner-Denver manufactures pumps and pumping equipment. CECO Environmental Corp. (CECE) acquired Met-Pro Technologies, a manufacturer of industrial filters and pumping equipment, from Blackrock and others in a transaction valued at approx. $200 million. Finally, Ametek Inc. (AME) acquired Controls Southeast, Inc., a manufacturer of specialty piping and valves from Industrial Growth Partners and others for approx. $160 million.

Flow Control Public Comparables

Flow Control Selected Transactions

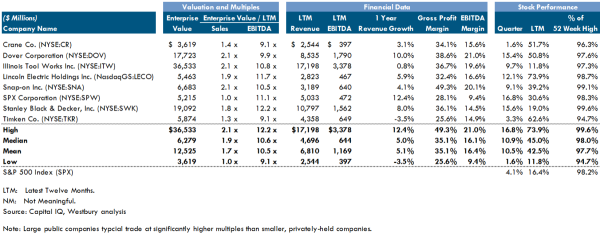

Industrial Equipment

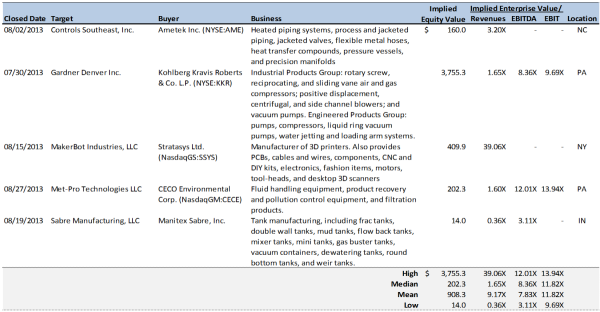

Industrial Equipment Public Comparables

Industrial Equipment Selected Transactions

Measurement and Control

Companies in this sector manufacture devices that meter or measure a variety of tangible substances – gases, fluids, solids -- and various physical forces or properties like temperature, electricity, magnetism, hardness, light, mass and inertia. They also manufacture devices that act as valves to control such substances and properties, in addition to systems that distribute substances.

Measurement and Control Public Comparables

Measurement and Control Selected Transactions