Expansion in American Manufacturing

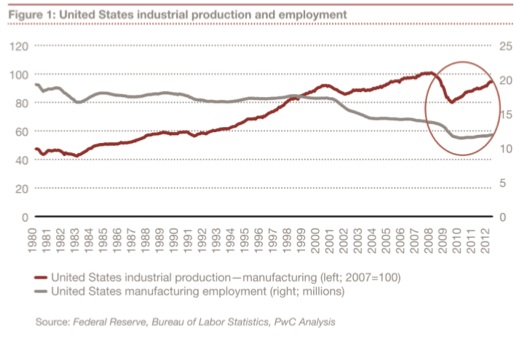

According to the Bureau of Economic Analysis, Industry Economic Accounts (2011), the Manufacturing sector provides around $1.8 trillion of value to the US economy or 12.2% of the GDP. This vital sector is poised to rebound after several years of decline caused by the world-wide recession that hit in 2008. Manufacturing supports an estimated 17.2 million jobs in the United States—about one in six private-sector jobs. Nearly 12 million Americans (or 9 percent of the workforce) are employed directly in manufacturing. U.S. Manufacturers also account for two-thirds of all private-sector R&D in the nation.

The tale of North American manufacturing is one of competing headlines. On the one hand, Westbury bankers have spoken to numerous manufacturing executives who have conveyed their experiences of bringing manufacturing back from the East Asia, particularly China, to the U.S. News reports have supported the validity of this onshoring trend. One site, reshorenow.org, has archived 287 articles since 2010 cataloging over 50,000 jobs brought back to the U.S. In September, Price Waterhouse Coopers release a report, A homecoming for US manufacturing?, stating that U.S. transportation, energy and currency advantages (and the same hold true for Canada) could accelerate onshoring.

On the other hand, another headline indicates that the second quarter got off to a thud. On April 1, the Institute for Supply Management (ISM) released a disappointing report, saying its index of national factory activity fell to 51.3 from 54.2 the month before. The measurement fell significantly short of the expected of 54.2, expected economists per a Reuters poll, even though any reading above 50 signifies expansion. The severe winter weather in the first quarter coupled with continued Washington budget impasses may be the culprits.

So which headline will prevail? We believe the ISM report reflects short-term potholes in the road to manufacturing recovery. Our money is on continued expansion.

Following the lean years of 2008-2011, Westbury expects that manufacturers will continue to expand margins as they complete restructuring efforts and align costs. Companies continue to maintain conservative balance sheets and moderating their R&D spend to keep costs in line while maintaining product pipelines. Manufacturers have not replaced the personnel they laid off during the recession, yet have largely recovered to pre-recession production levels.

Another positive factor is that manufacturers have profited from efforts to grow sales in emerging markets, where demand is expanding more rapidly than in the developed world. This positive influence is balanced by the continued slow worldwide economic recovery.

Manufacturing M&A Environment

2013 is witnessing a continued interest in mergers and acquisitions in the manufacturing sector. However, the pace in the first quarter of 2013 has slowed compared to the same period in 2012, perhaps due to rising valuations. Westbury tracked 50 deals closed in the first quarter of 2013 versus compared with 77 for the same period in 2012.

With interest rates remaining at historic lows, Westbury believes that leading manufacturing companies will continue to make strategic and opportunistic acquisitions to diversify their revenue streams and support top-line growth. With advantageous cost of capital and manageable valuations, manufacturing companies can acquire strategically important targets that are accretive to earnings.

Diversified Industrials

Diversified Industrials consists of those manufacturing companies whose production encompasses a broad range of offerings. For example, Danaher Corp. (NYSE:DHR) produces test and measurement equipment, electromechanical components and subsystems for the industrial automation and packaging markets, ultraviolet water treatment systems, and commercial printing systems, just to name several.

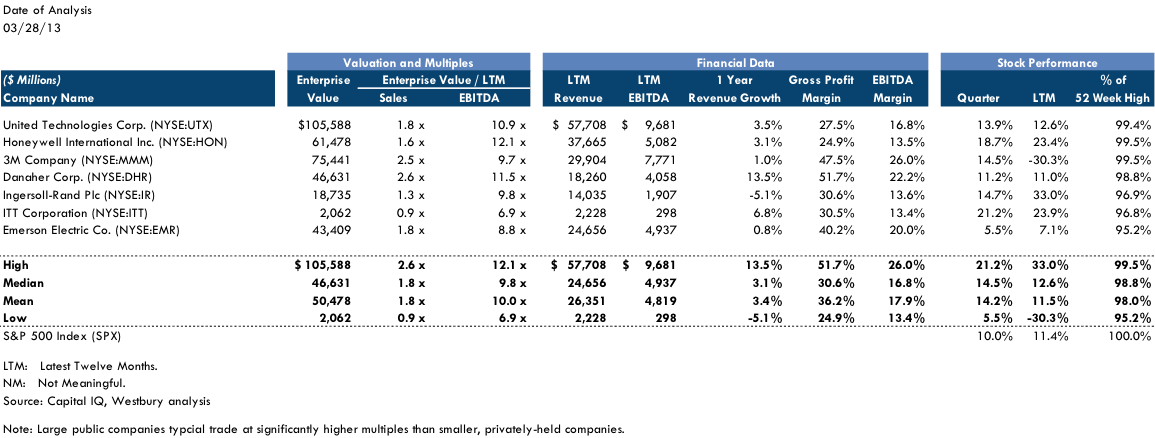

Diversified Industrials Public Comparables

Diversified Industrials Selected Transactions

Acquisitions of note among diversified industrial companies in the first quarter of 2013 include National Oilwell Varco, Inc.’s (NYSE:NOV) acquisition of Robbins & Myers, Inc. (NYSE:RBN). Robbins & Myers produces engineered, application-critical equipment and systems. At a 10.8x Enterprise Value/EBIT, the transaction represents a healthy return for RBN shareholders. Another very attractive multiple paid in the first quarter of this year was The Hillman Companies, Inc.’s purchase of H. Paulin & Co. Ltd., a maker of bolts, nuts, screws, industrial fasteners, fluid system components, metal stampings, automotive parts, and screw machine components. That deal was done at a 12.9x multiple of Enterprise Value/EBIT.

| Implied Enterprise Value/ | ||||||||

|---|---|---|---|---|---|---|---|---|

| Closed Date | Target | Buyer | Business | Implied Equity Value | Revenues | EBITDA | EBIT | |

| 02/20/2013 | Robbins & Myers Inc. | National Oilwell Varco, Inc. (NYSE:NOV) | Engineered, application-critical equipment and systems | 2,544.4 | 2.39X | 9.44X | 10.76X | |

| 02/01/2013 | Apex Tool Group, LLC | Bain Capital Private Equity | Power tools and professional electronic tools | 1,600.0 | 1.07X | |||

| 01/31/2013 | Fusion UV Systems, Inc. | Heraeus Holding GMBH | Industrial UV curing systems, light sources, and UV-based process solutions used in various manufacturing applications | 172.0 | 13.23X | |||

| 02/19/2013 | H. Paulin & Co. Ltd. | The Hillman Companies, Inc. | Bolts, nuts, screws, industrial fasteners, fluid system components, metal stampings, automotive parts, and screw machine components. | 94.3 | 0.70X | 11.38X | 12.94X | |

| 02/11/2013 | T.F. Hudgins, Incorporated | The CapStreet Group, LLC | Industrial equipment for oil and gas, automotive, and energy sectors | |||||

| High | $ 2,544.4 | 2.39X | 11.38X | 13.23X | ||||

| Median | 886.0 | 1.07X | 10.41X | 12.94X | ||||

| Mean | 1,102.7 | 1.39X | 10.41X | 12.31X | ||||

| Low | 94.3 | 0.70X | 9.44X | 10.76X | ||||

Electrical and Electronic Components

Companies in the Electrical and Electronic Components segment manufactures products that generate, distribute and use electrical power. Products include electric lamp bulbs, lighting fixtures, and parts, electrical appliances, electric motors, generators, transformers, and switchgear apparatus, batteries, electrical wire and cable, and wiring devices, e.g., electrical outlets, fuse boxes, and light switches, and electronic components such as capacitors and resistors. This segment does not include semiconductors or printed circuit boards.

Whereas other North American manufacturing segments may benefit from the trend toward “re-shoring,” light manufacturers such as electrical equipment companies, which are affected less by transportation costs and more by labor costs, may find re-shoring a less persuasive business strategy. The segment is also under pricing pressure. Seasonally adjusted Producer Price Index for Electronic Components and Accessories actually declined 0.7% from March 2012 to March 2013 (Bureau of Labor Statistics, March 2013 Producer Price Index report, April 12, 2013).

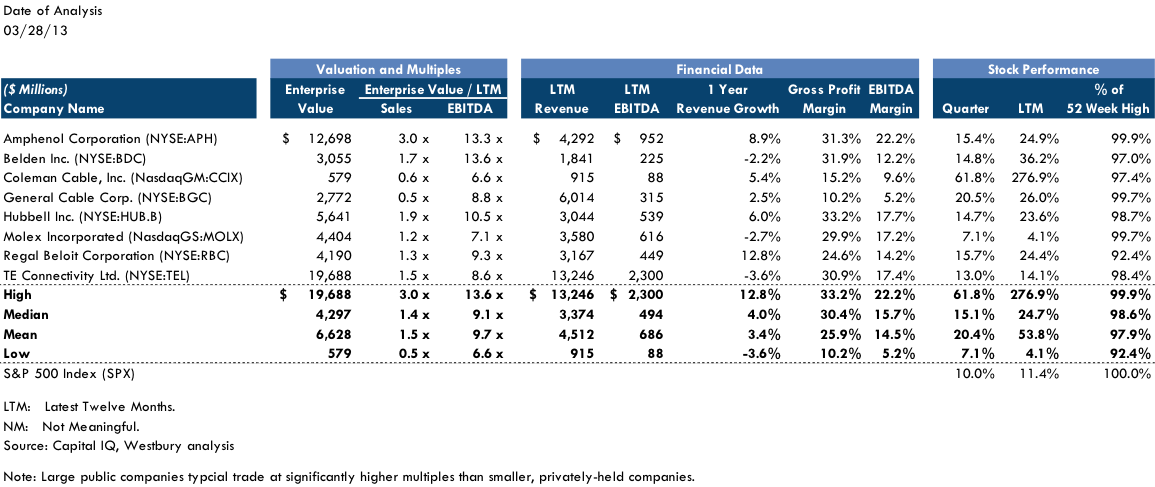

Electrical and Electronic Components Public Comparables

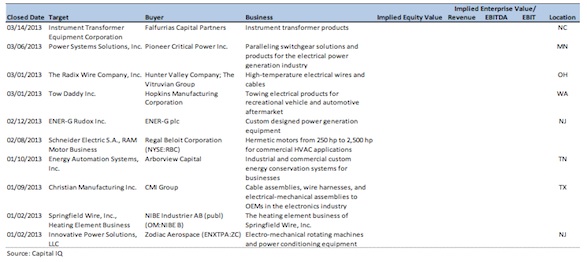

Electrical and Electronic Components Selected Transactions

Flow Control

Companies in the Flow Control sector manufacture and distribute industrial process controls such as industrial valves, pumps and filters used in oil and gas, chemical manufacturing and water treatment, among other applications. Increasingly, valves with automatic actuators are growing relative to conventional valves. Many of these companies also have fluid metering products such as gauges and pressure monitoring devices.

The flow control sector has rebounded solidly from the depressed levels of four years ago, driven by the recovery of the US economy as well as stronger demand from the Asia/Pacific region. Renewed capital spending, which had been deferred during the economic downturn, and the need for improved efficiency by the industrial sector have contributed to this rebound. The Oil and Gas sector, both in the US and overseas, has been another important driver combined with the impact of earlier. 2012 was a particularly active year for M & A activity highlighted by Pentair’s acquisition of Tyco’s flow control business creating the dominant player in this sector. Increasing globalization and rising demand for suppliers with global capability has and will continue to drive industry consolidation. Strategic players have cash on their balance sheets and are able to take advantage of the smaller players’ product offerings, which would indicate continuing M & A activity through 2013.

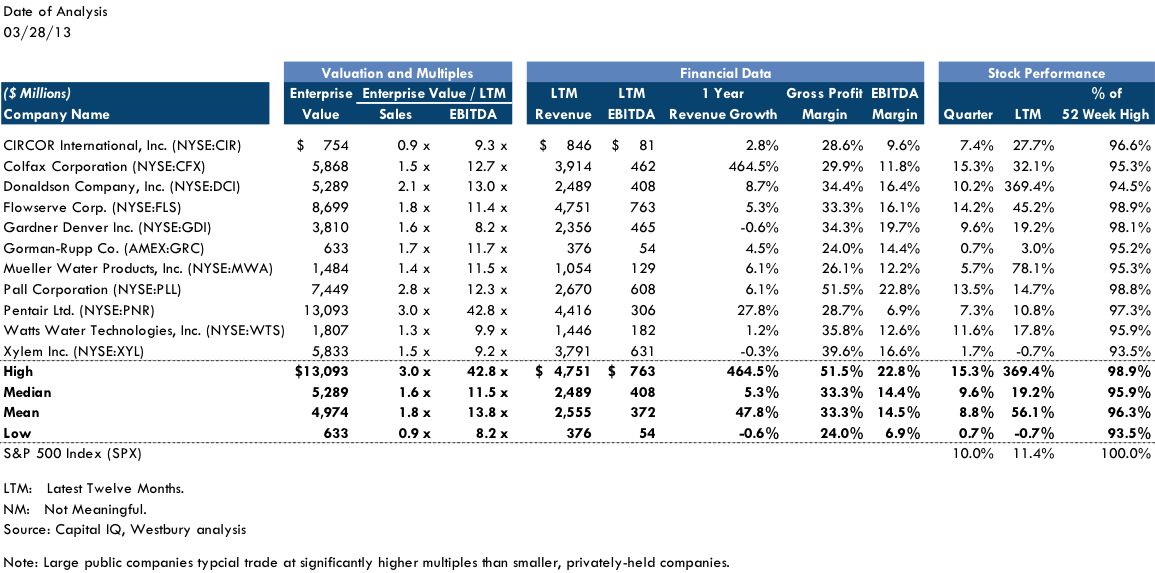

Flow Control Comparables

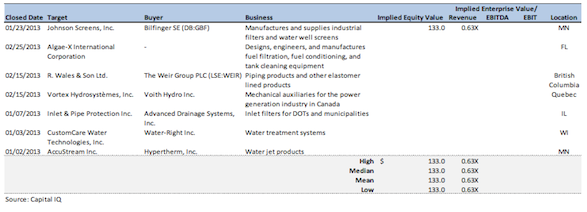

Flow Control Selected Transactions

Industrial Equipment

The US Industrial Machinery sector is a substantial contributor to the US GDP. This sector encompasses manufacturers of machines that produce components used in everyday household items to huge industrial machines such as floor borers and custom-engineered transformers. Machinery industries generated revenues of $361 billion in 2010, of which $141 billion were exports.[1] These exports increased by 14% in 2011 to $161 billion.

In a recent report from HSBC,[2] the Industrial Machinery sector is expected to be the major catalyst for driving US exports and imports of machinery product. This sector is expected to provide 21% of the growth of exports from 2013 through 2015 and then 25% of the export growth from 2016 through 2020.

More recently, in 2012, these industries employed over 1.1 million people and supported millions more in affiliated manufacturing and service industries.

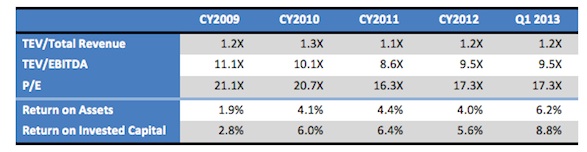

Industrial Equipment Key Ratios

As can be seen below, in CY2012 the TEV/Total Revenues ratio bounced back to 1.2 from its recent low of 1.1 in 2011. Similarly, the P/E ratio came in at 17.3 in 2012 versus 16.3 in the prior year.

This sector appears to be solidifying its financial strength as Return on Assets in the first quarter of 2013 reached 6.2%, up from 4.0% in 2012 (a 55% increase). Similarly, return on invested capital hit 8.8% in the first quarter of 2013, up from 6.4% in 2012 (a 38% increase).

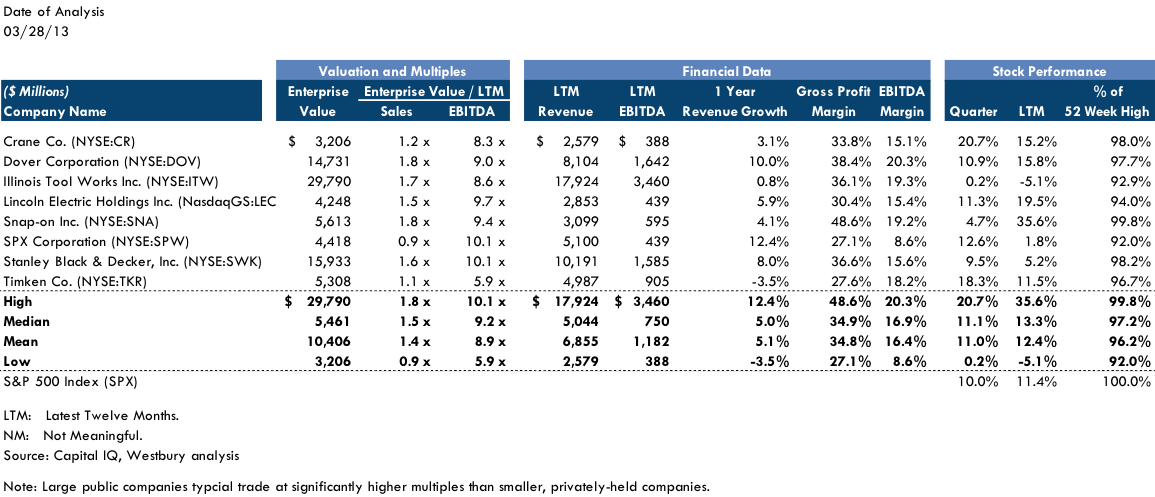

Industrial Equipment Public Comparables

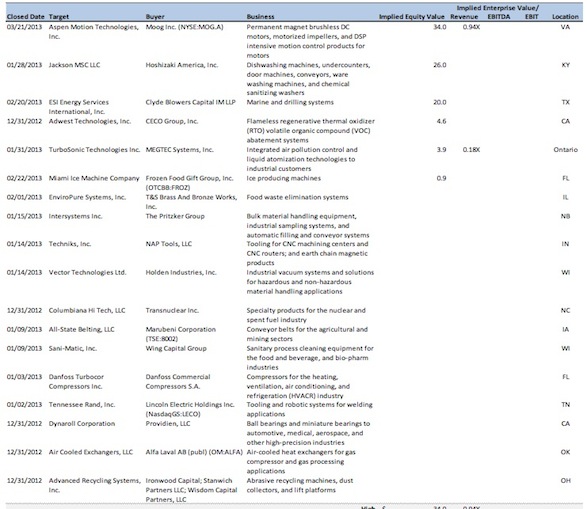

Industrial Equipment Selected Transactions

Measurement and Control

Companies in this sector manufacture devices that meter or measure a variety of tangible substances – gases, fluids, solids -- and various physical forces or properties like temperature, electricity, magnetism, hardness, light, mass and inertia. They also manufacture devices that act as valves to control such substances and properties, in addition to systems that distribute substances.

Measurement examples: fuel meters (gas, oil, electricity), blood cell counters, altimeters, accelerometers, x-ray diffraction devices, mass spectroscopy and electrophoresis devices, etc.

Control examples: Sensors, hydraulic systems, communications systems, aircraft surfaces, compressors, traffic control, energy dissipators, etc.

The NAFTA trading region is the largest consumer of measurement and control products, accounting for about 35% of the global total. Europe accounts for 30%.

As might be expected for such large companies heavily integrated into the US and global economy, recent growth has been moderate, about 5.5% since last March. In “normal” times, industry growth averages 8% - 10%. However, the market seems to appreciate even the current level of moderate growth after years of slow recovery and continuing economic uncertainty, awarding these companies with a mean stock price increase of 12.2% over the last 12 months.

Ever-shortening product life cycles are driving demand for more rapidly evolving measurement and control devices, especially those related to digital products.

Aging distributed control systems and technologies like SCADA present new sales opportunities. However, a heavy SCADA-using market, utilities, is starved for capital.

In a related development, analysts expect strong growth in wireless control and measurement systems.

The Affordable Care Act included an excise tax on medical devices, many of which feature measurement and control functions, could curtail demand for medical devices in the US. However, the recently passed Senate 2014 Budget Resolution calls for the repeal of that excise tax and may presage its elimination.

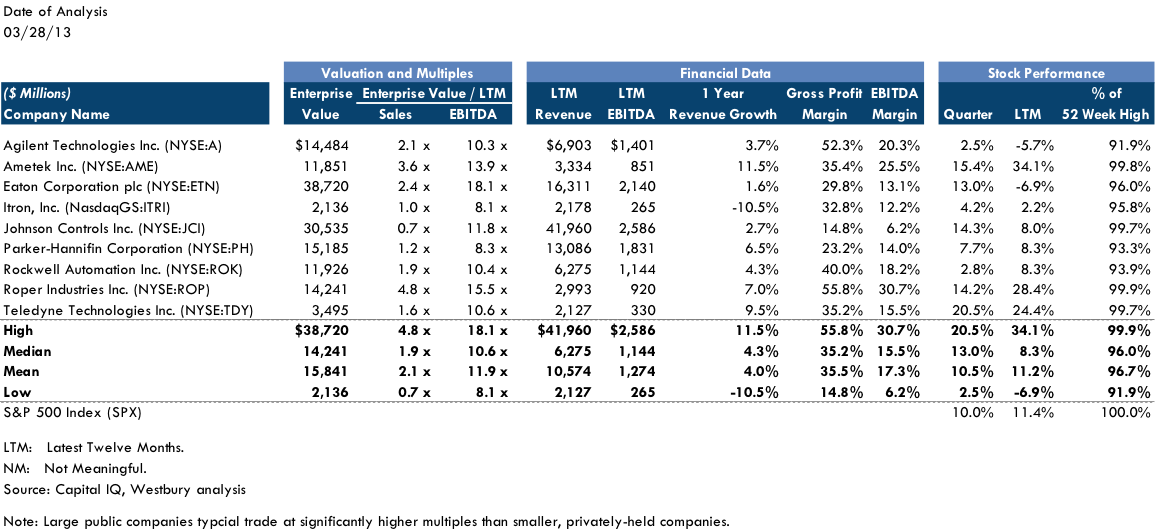

Measurement and Control Public Comparables

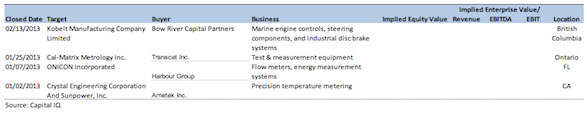

Measurement and Control Selected Transactions

Research Team

- Jonathan Rubin, Group Head, Flow Control

- Alan Carter, Industrial Equipment

- Ryan Kuhn, Measurement and Control

- Robert Maxwell, Electrical and Electronic Components

- Andrew Winick, Diversified Industrials

Notice & Disclaimer

These materials were prepared by Westbury Group, LLC (“Westbury”), a broker-dealer registered with the Securities and Exchange Commission (“SEC” at www.sec.gov) and a member of the Financial Industry Regulatory (“FINRA” at www.finra.org) and the Securities Investor Protection Corporation (“SIPC” at www.sipc.org).

Westbury may act as investment banker to specific companies in the industry sectors described in this report by providing merger, acquisition, divestiture, private placement and other advisory services.

Westbury gathers its data from sources it considers reliable. However, it does not guarantee the accuracy or completeness of the information provided in this report. The material provided herein reflects information known to the authors at the time this report was written and such information is subject to change. Westbury makes no representations or warranties, expressed or implied, regarding the accuracy or completeness of this report.

Information, opinions and any estimates contained in this report reflect Westbury’s judgment as of the date written and are subject to change without notice. Westbury undertakes no obligation to notify any recipient of this report of any such change.

This report does not constitute advice or a recommendation, offer or solicitation with respect to the securities of any company discussed herein, is not intended to provide information upon which to base an investment decision, and should not be construed as such. Officers, directors, partners and employees of Westbury and its affiliates may have positions in the securities of the companies discussed, if any.

This report is not directed to, or intended for distribution to, any person in any jurisdiction where such distribution would be contrary to law or regulation.

Any public companies presented in this report are companies commonly used for industry information to show performance within a sector. They do not include all public companies that could be characterized within the identified sector and do not constitute recommendations for a particular security or sector. The charts, graphs and tables used in this report have been compiled by Westbury solely for the purposed of illustration.

Fatal error: Class CToolsCssCache contains 1 abstract method and must therefore be declared abstract or implement the remaining methods (DrupalCacheInterface::__construct) in /var/www/we/westburygroup.com/public_html/sites/all/modules/ctools/includes/css-cache.inc on line 52